20 Vegetable Garden Layout Ideas With Practical Tips and Detailed Plans

Gardening isn’t just about sticking seeds in the ground and hoping for the best—layout plays a huge role in how productive, beautiful and enjoyable your vegetable patch will be. A well‑planned design maximizes space and ensures healthy growth.

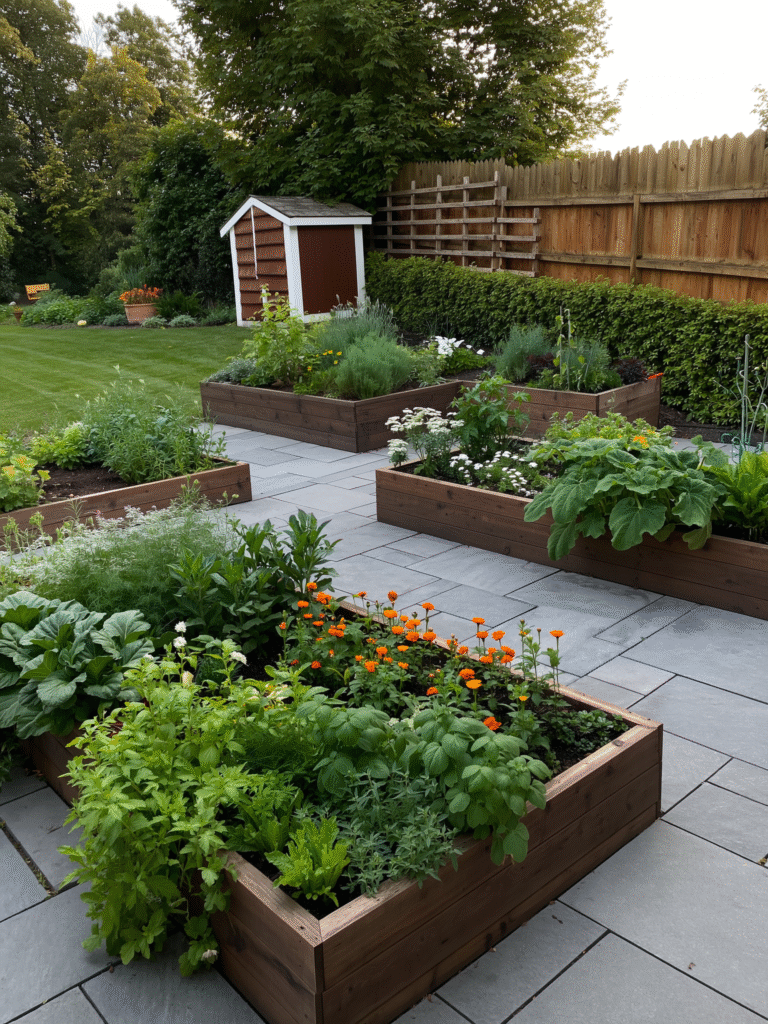

1. Raised Bed Layout

Raised beds are essentially freestanding boxes of soil built above ground level. They improve drainage, warm up quickly in spring and make it easier to control soil quality. Beds should be narrow enough—about 90–120 cm (3–4 ft) wide—to reach the centre without stepping on the soil. Paths between beds need to be wide enough for a wheelbarrow (60–90 cm/2–3 ft). Orient beds north–south so plants receive even sunlight.

Advantages

- Great for clay soil or areas with poor drainage. Because the soil is elevated, excess water drains away and compaction is minimized.

- Easier on the back; you can experiment with different bed heights to accommodate mobility issues.

- Warms up earlier in the season, allowing an extended growing period.

Considerations

- Building materials cost more than simply digging in‑ground beds.

- Beds dry out faster; regular watering or drip irrigation is essential.

Good plants for raised beds: salad greens, carrots, radishes, onions, strawberries and herbs. Avoid tall crops like corn or large sprawling squash unless beds are very wide.

2. Grid (Square‑Foot) Layout

In the grid system, a bed is divided into 30 cm (1 ft) squares using string, sticks or wooden slats. Each square is planted densely with one type of crop—one tomato per square, four lettuces or nine bush beans, for instance. This approach is excellent for beginners because it provides a clear planting plan and uses space efficiently.

Advantages

- Efficient use of small spaces; great for balconies or compact gardens.

- Keeps track of plant varieties; you can easily see what’s growing where.

- Easy to maintain: weeds are suppressed by dense planting.

Tips

- Amend the soil well with compost—intensive planting draws a lot of nutrients.

- Label each square with plant names to simplify harvesting and crop rotation.

3. Traditional Row Layout

Classic row planting involves arranging crops in long lines with paths between them. It’s straightforward and works well in large plots. Row widths and spacing depend on crop type; leafy greens may be planted 30 cm apart, whereas sprawling squash may require 1 m or more.

Advantages

- Easy access for hoes, wheelbarrows and irrigation systems.

- Ideal for mechanized or large‑scale gardens.

- Provides clear delineation for succession planting and intercropping.

Tips

- Position tall plants (corn, trellised tomatoes) on the north or east side so they don’t shade shorter crops.

- Mulch paths with straw or wood chips to reduce weeds and erosion.

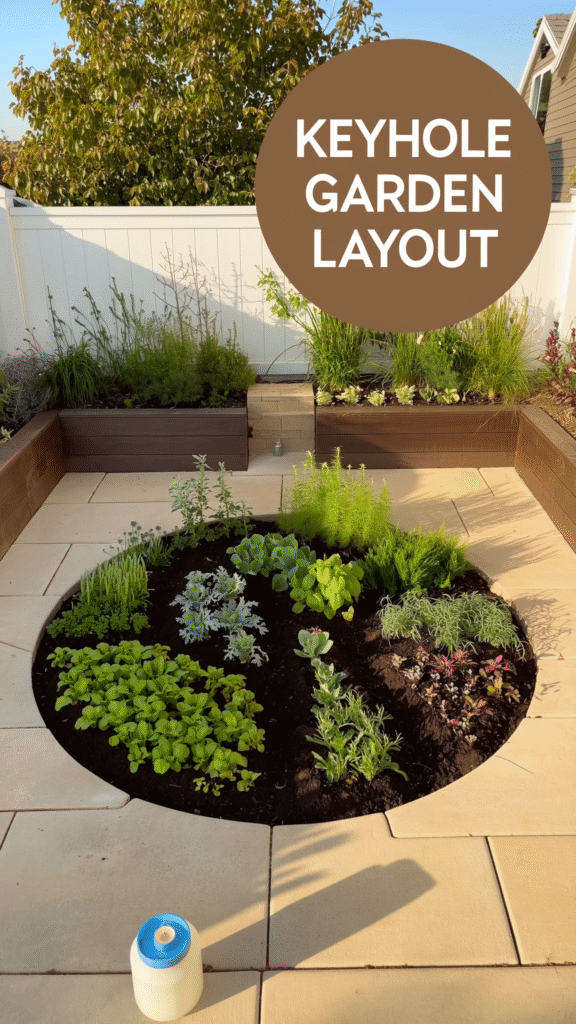

4. Keyhole Garden Layout

A keyhole garden is a circular raised bed with a pie‑slice cut‑out path leading to the centre, where a compost basket sits. Organic kitchen scraps and water are added to the basket, providing nutrients that radiate outwards. This layout is ideal for small urban yards and arid climates because it’s water‑efficient.

Advantages

- Extremely water‑efficient and self‑fertilizing: the central compost basket feeds plants and retains moisture.

- Allows easy access to all parts of the garden without stepping on the soil.

- Supports sustainable gardening practices.

Tips

- Use drought‑tolerant vegetables like peppers, eggplant and herbs around the outer circle; plant moisture‑loving crops like lettuce closer to the compost column.

- Build the bed with stones or bricks to hold heat and moisture.

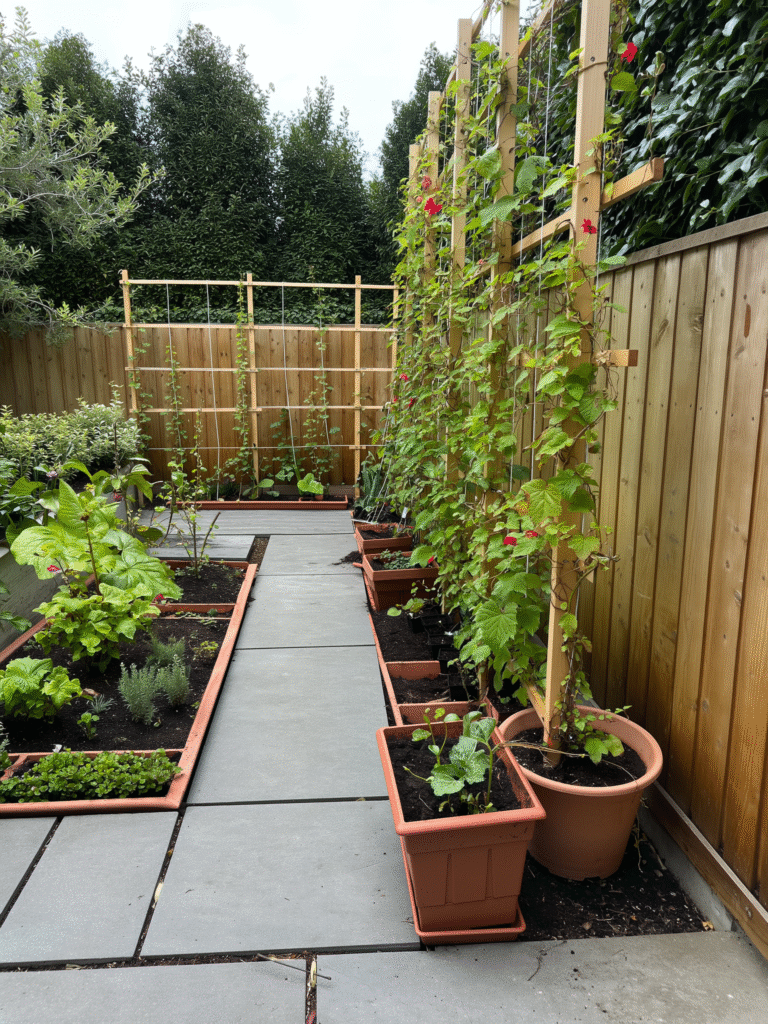

5. Vertical Garden Layout

Vertical gardening uses walls, trellises, arbors and stacked planters to grow plants upward instead of outward. This method is essential for urban gardeners with limited ground space.

Advantages

- Maximizes production per square metre; climbing plants like beans, peas and cucumbers thrive when supported.

- Frees up ground space for low‑growing crops or seating.

- Improves air circulation and reduces disease pressure.

Tips

- Choose sturdy trellises and secure them firmly; heavy vines need strong support.

- Pair vertical structures with a drip irrigation line to ensure even watering.

6. Companion Planting Layout

Companion planting groups crops that benefit each other’s growth. Classic pairs include tomatoes with basil, carrots with onions and cabbage with dill. This method supports natural pest control and improves yields.

Advantages

- Encourages symbiotic relationships and enhances flavour in certain crops.

- Naturally deters pests (e.g., marigolds repel nematodes and whiteflies).

- Provides more biodiversity in a small area.

Tips

- Avoid pairing plants that compete for nutrients (e.g., onions and beans). Use a companion planting chart to plan combinations.

- Incorporate aromatic herbs (basil, thyme) at the ends of beds to attract pollinators and repel pests.

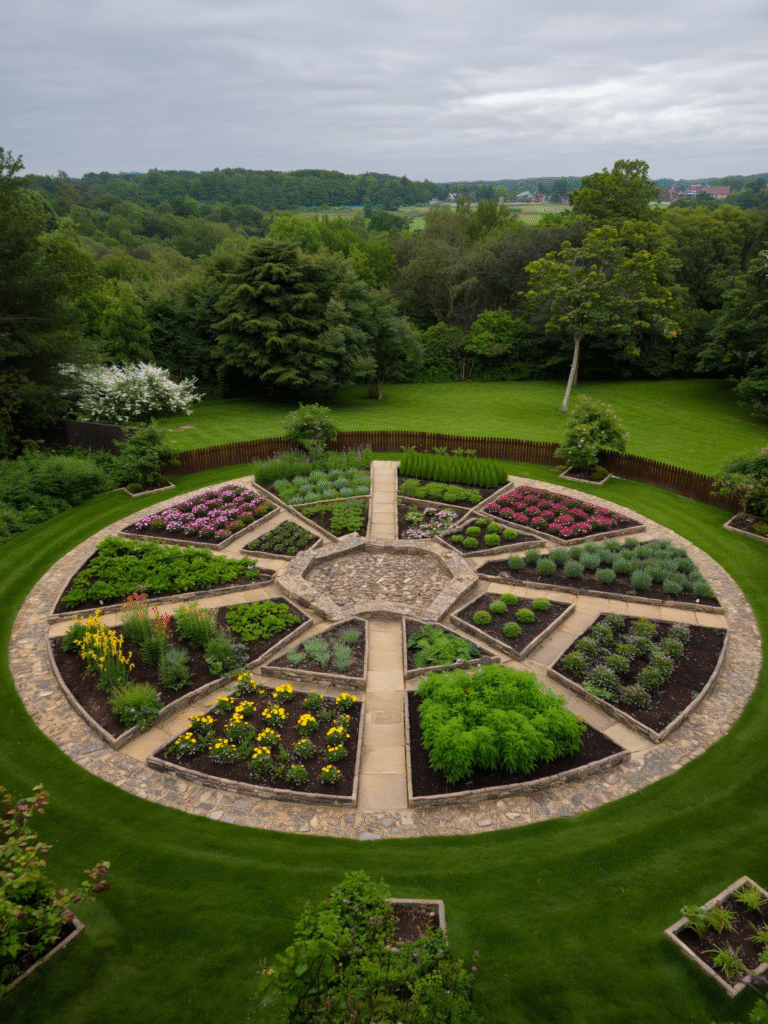

7. Mandala Garden Layout

The mandala garden uses concentric circles with radiating paths to create a symmetrical, meditative space. Raised beds or ground‑level beds form segments where different crops are planted. This design is visually striking and often employed in permaculture gardens.

Advantages

- Allows easy access to every bed from a central point.

- Encourages creativity and mindfulness while gardening.

- Great for growing a variety of plants in separate microclimates (the centre receives more shade).

Tips

- Use curved, mulched paths about 45–60 cm wide for comfortable access.

- Plant taller crops on the outer ring and shade‑tolerant herbs closer to the centre.

8. Potager (Ornamental Kitchen) Garden

The potager combines vegetables, herbs and flowers in an ornamental design. Inspired by French kitchen gardens, it’s both productive and beautiful, often arranged in geometric patterns and edged with low box hedges or brick paths.

Advantages

- Enhances biodiversity and attracts pollinators.

- Provides edible produce alongside ornamental beauty.

- Encourages succession planting because empty spaces can be quickly filled with flowers or herbs.

Tips

- Use repeating shapes (circles, squares) and symmetry for a cohesive look.

- Pair colourful edible plants—purple kale, rainbow chard and nasturtiums—to heighten visual interest.

9. Raised Rows Layout

Raised rows are created by mounding soil into long, narrow beds with furrows between. Unlike wooden boxes, these rows are formed directly from your native soil. They improve drainage and are easy to build.

Advantages

- Simple and inexpensive to set up—no lumber required.

- Mounded soil warms faster in spring and drains excess water effectively.

- Rows can be reshaped or moved from year to year.

Tips

- Incorporate plenty of organic matter into the mounds to retain moisture.

- Mulch the furrows to suppress weeds and reduce erosion.

10. Container Garden Layout

Container gardening uses pots, grow bags, buckets and vertical planters to cultivate vegetables on patios, balconies or rooftops. Containers allow gardeners to control soil quality and move plants to follow the sun.

Advantages

- Perfect for renters or those with limited space—grow anywhere from balconies to driveways.

- Reduces soil‑borne diseases and pests.

- Easier to manage soil fertility and drainage.

Tips

- Choose lightweight containers with drainage holes; heavy pots are harder to move.

- Use a high‑quality potting mix and feed regularly with organic fertilizer.

- Consider self‑watering containers to maintain consistent moisture.

11. Four‑Square Layout

The four‑square design divides the garden into four equal beds separated by paths. Each quadrant is dedicated to a different plant family—leafy greens, roots, fruiting crops and legumes—which makes crop rotation simple.

Advantages

- Simplifies crop rotation and prevents soil nutrient depletion.

- Creates clear organization and easy access to each bed.

- Allows you to tailor soil amendments for different crop types.

Tips

- Rotate each plant family clockwise each year to minimize pest and disease buildup.

- Install a central water source (such as a drip manifold) at the intersection of the paths.

12. In‑Ground Bed Layout

Planting directly into prepared soil remains one of the most versatile and affordable methods. Define beds with ropes or boards and leave paths in between. Double digging or broad‑forking loosens soil deeply, improving root growth.

Advantages

- Low cost; no need for lumber or raised structures.

- Flexible shapes and sizes—ideal for large gardens.

- Easily integrates cover crops and green manures.

Tips

- Amend soil with compost and aged manure annually to maintain fertility.

- Avoid stepping on the beds; place stepping stones or boards if necessary.

13. Spiral Garden Layout

The spiral garden uses a circular mound that winds upwards like a snail shell. The higher portion receives more sun and drainage, while lower sections stay moister.

Advantages

- Creates multiple microclimates in a small footprint.

- Ideal for herbs and small vegetables—plant Mediterranean herbs (rosemary, thyme) at the top and moisture‑loving plants (mint, chives) near the bottom.

- Adds sculptural interest to the garden.

Tips

- Build the spiral with stones, bricks or reclaimed materials for stability.

- Mulch the pathways between coils to suppress weeds and conserve moisture.

14. Mixed Border Layout

The mixed border incorporates edible plants along existing borders—around fences, paths or patios—alongside ornamental perennials. This design saves space and adds visual appeal.

Advantages

- Utilizes otherwise underused edges of the garden.

- Attracts pollinators and beneficial insects with flowers and herbs.

- Creates a multi‑layered, ornamental effect.

Tips

- Plant taller vegetables like okra or Jerusalem artichokes at the back, medium‑height crops (chard, kale) in the middle and low groundcovers (thyme, strawberries) at the front.

- Include perennial flowers such as echinacea and lavender to attract bees and provide year‑round structure.

15. Themed Garden Layout

Designing around a theme adds fun and purpose to your garden. A pizza garden arranges tomatoes, peppers, basil and oregano in circular “slices,” while a salad garden groups lettuces, cucumbers and radishes.

Advantages

- Encourages children and beginners to engage in gardening.

- Helps focus crop selection; you grow exactly what you need for favorite dishes.

- Can be combined with decorative shapes and colours.

Tips

- Plan for sequential harvesting—plant quick‑growing salad greens between slower‑maturing tomatoes and peppers.

- Use signage or painted labels for each “slice” to add whimsy.

16. Tiered (Terraced) Layout

For sloped yards, terracing makes the land usable by creating flat planting areas. Retaining walls built from wood, stone or brick hold back soil. Terraced beds reduce erosion and improve water distribution.

Advantages

- Controls runoff and prevents soil erosion on slopes.

- Maximizes planting area on uneven terrain.

- Adds depth and visual interest to the landscape.

Tips

- Install sturdy retaining walls and consult a professional for steep slopes.

- Orient terraces along contour lines to slow water flow.

- Plant deep‑rooted perennials (comfrey, asparagus) on lower terraces to absorb nutrients.

17. U‑Shaped Garden Layout

The U‑shaped layout forms a horseshoe with three connected beds, leaving an open centre walkway. This ergonomic design allows you to reach plants from the inside and outside without stepping into the bed.

Advantages

- Highly ergonomic—no need to stretch or lean far to harvest.

- Efficient for intensive planting and succession cropping.

- Works well for raised beds or in‑ground beds with firm edging.

Tips

- Make the U at least 90 cm (3 ft) wide on each side, and leave a central aisle of 60 cm (2 ft) for comfortable access.

- Use trellises on the sides of the U to grow climbing plants without sacrificing walkway space.

18. Zigzag Path Layout

Adding zigzag paths introduces a playful, artistic element to the garden. The angled beds increase edge space—perfect for edible flowers and herbs—and improve access by shortening walking distances.

Advantages

- Provides unique visual interest and breaks up large rectangular plots.

- Creates microclimates along the angled edges.

- Helps manage water runoff and soil differences.

Tips

- Keep path widths consistent; irregular paths can become tripping hazards.

- Use the bends to plant focal points such as ornamental kale or sculptures.

19. Wildlife‑Friendly Layout

This design integrates habitat for beneficial wildlife—pollinator strips, bird feeders, native plants and shallow water dishes—into your vegetable plot. Supporting biodiversity helps control pests naturally and improves pollination.

Advantages

- Attracts helpful insects like ladybirds and lacewings.

- Supports local ecosystems and increases ecological resilience.

- Creates a more dynamic and educational garden.

Tips

- Plant a succession of nectar‑rich flowers (cosmos, zinnias, sunflowers) along garden edges.

- Provide a water source—shallow dishes with stones—for bees and butterflies.

- Avoid pesticides; use organic controls and encourage predatory insects.

20. Cluster Planting Layout

Cluster planting groups vegetables in irregular clusters rather than straight rows. Plants are selected based on similar water and nutrient needs and arranged to mimic natural plant communities.

Advantages

- Makes efficient use of irregularly shaped plots and small spaces.

- Encourages companion planting and a more natural look.

- Reduces weed pressure by shading soil.

Tips

- Sketch your plot on paper and group crops with similar growth habits together; for example, plant a cluster of leafy greens, root crops and a tall support plant like corn or sunflowers.

- Leave small paths between clusters (30–45 cm) to allow access for harvesting and maintenance.

Additional Design Tips and Considerations

(image prompt: a gardener sketching a planting plan on graph paper with seed packets and measuring tape nearby)

- Know your climate and sunlight. Observe how many hours of sun each part of your yard receives and choose crops accordingly. Leafy greens can handle partial shade, while fruiting vegetables need at least 6–8 hours of direct sun.

- Plan for irrigation. Install drip lines or soaker hoses before planting to avoid disturbing roots later. Group plants with similar water requirements together.

- Rotate crops annually. Rotating plant families helps break pest and disease cycles and balances soil nutrients.

- Keep a garden journal. Record planting dates, varieties and yields to refine your layout each year.

- Add extra touches. Vertical trellises, decorative arches and focal points such as benches or bird baths enhance the garden’s beauty and functionality.

Conclusion

Designing a vegetable garden is as much about creativity as it is about practicality. The twenty layouts above offer a range of solutions—from tidy raised beds to whimsical mandala patterns—for every space and gardener. By considering sunlight, soil quality, water access and your own aesthetic preferences, you can craft a productive and beautiful kitchen garden. Whether you build terraces on a slope, create a wildlife sanctuary or mix veggies with flowers, thoughtful planning will reward you with healthy crops and a space you love to spend time in. Use the image prompts as inspiration for your own designs, and let your garden evolve each season.

Deliberate Practice for Professionals: How to Excel in Any Field Using Science-Backed Methods

Understanding Deliberate Practice: The Science of Excellence

Deliberate practice represents a research-based approach to skill acquisition that systematically differentiates elite performers from their peers across diverse domains. First identified by psychologist K. Anders Ericsson through his pioneering research in the 1990s, this method transcends simplistic notions of “practice makes perfect” to establish a rigorous framework for continuous improvement. While conventional practice often involves comfortable repetition of familiar skills, deliberate practice deliberately operates at the edge of current capabilities, targeting specific weaknesses through structured activities designed to overcome them. This fundamental distinction explains why many professionals plateau despite years of experience—they accumulate hours of activity without implementing the precise mechanisms that drive substantial skill development.

The neurological foundations of deliberate practice reveal why conventional approaches to skill acquisition often prove inadequate. Research utilizing advanced neuroimaging techniques demonstrates that deliberate practice triggers myelination—the process where neural pathways are insulated with fatty tissue, dramatically increasing signal transmission speed between neurons. This biological adaptation only occurs when specific neural circuits are intensively activated through focused, challenging practice. Additionally, deliberate practice facilitates dendritic branching, where neurons develop new connections in response to targeted stimulation, creating more robust neural networks associated with expert performance. These neurological adaptations explain why deliberate practice must incorporate specific elements absent from routine activities—namely, appropriate difficulty, immediate feedback, and focused attention.

Deliberate practice operates through four key mechanisms that distinguish it from routine performance. First, it employs tight feedback loops where performance deviations are immediately identified and corrected, preventing the reinforcement of suboptimal patterns. Second, it utilizes progressive overload, systematically increasing challenge levels as capabilities improve to maintain optimal difficulty. Third, it leverages distributed practice effects, scheduling training sessions to maximize consolidation of neural adaptations between practice periods. Finally, it harnesses retrieval-based learning, where information or skills must be actively recalled rather than passively reviewed, strengthening neural pathways through the effortful reconstruction of knowledge.

Common misconceptions about expertise development continue to impede professional growth in many fields. The popular “10,000-hour rule”—a simplified interpretation of Ericsson’s research—incorrectly suggests that expertise development is primarily about accumulating practice time. However, the research clearly demonstrates that the structure and quality of practice determine outcomes far more than quantity alone. Similarly, the persistent myth that innate talent primarily determines performance ceilings has been consistently refuted by research showing that cognitive and physical characteristics become less predictive of achievement as deliberate practice accumulates. Understanding these scientific foundations allows professionals to implement evidence-based approaches to skill development rather than relying on conventional wisdom or intuitive methods that often yield disappointing results despite substantial time investments.

Identifying High-Impact Skills: Where to Focus Your Efforts

Strategic skill selection represents the critical first step in implementing effective deliberate practice. Rather than attempting to improve across all dimensions simultaneously—an approach that typically yields superficial gains—elite performers methodically identify specific skills offering disproportionate returns on invested effort. This selective approach requires analyzing your professional domain through the lens of leverage points—areas where relatively modest skill improvements generate outsized performance impacts. Begin by conducting a performance diagnosis that distinguishes between limiting factors (skills that currently constrain your overall effectiveness) and differentiating factors (capabilities that separate top performers from average ones in your field). This analysis requires objective self-assessment complemented by external feedback to overcome the blind spots that naturally develop in self-evaluation.

Developing skill selection frameworks provides structure to what might otherwise become a subjective process. The Pareto analysis technique identifies skills exhibiting 80/20 characteristics—those where 20% of capabilities potentially deliver 80% of performance outcomes. Similarly, the bottleneck identification approach focuses on the weakest links in your professional capability chain, recognizing that overall performance is often constrained by specific skill deficiencies rather than average capability levels. The “future-proofing” framework analyzes emerging industry trends to identify skills likely to increase in value as your field evolves, allowing you to develop capabilities before they become widely recognized as essential. These structured approaches prevent the common pitfall of gravitating toward comfortable skill areas rather than those offering the greatest professional leverage.

Industry-specific priorities create important contextual differences in high-impact skill selection. In technology fields, capabilities that enhance learning velocity—such as systematic debugging techniques, architecture pattern recognition, or first-principles thinking—typically yield higher returns than domain-specific knowledge that rapidly becomes obsolete. For management professionals, skills facilitating effective decision-making under uncertainty and emotional intelligence competencies enabling team alignment often provide greater leverage than technical expertise. In creative industries, methods for systematically generating and evaluating novel concepts typically distinguish exceptional performers more than technical execution abilities. These industry patterns provide valuable reference points for individual skill selection while recognizing that specific roles and career stages create unique skill leverage profiles.

Skill interdependencies create complex relationships that must be considered during selection. Some capabilities function as foundational skills that enable the development of numerous downstream abilities. For example, in knowledge work, information synthesis methods provide a foundation that enhances research, decision-making, and communication capabilities. Others operate as multiplier skills that amplify the effectiveness of existing capabilities—systematic thinking frameworks frequently serve this function by enhancing how effectively domain knowledge can be applied to novel situations. When designing a deliberate practice regimen, prioritize foundational and multiplier skills that create positive cascading effects throughout your professional capability portfolio. This strategic approach to skill selection creates the conditions for exponential rather than linear growth by targeting capabilities with complex positive externalities rather than isolated competencies.

Designing Effective Practice Routines for Professional Skills

Designing effective deliberate practice activities requires translating abstract skills into concrete, repeatable exercises. Begin by deconstructing complex professional capabilities into constituent sub-skills that can be isolated and intensively developed. For example, rather than practicing “presentation skills” broadly, isolate specific elements like narrative structure development, visual data representation, or audience engagement techniques. For each sub-skill, create practice activities exhibiting four essential characteristics. First, ensure they operate at the edge of current capabilities—challenging enough to require full concentration but not so difficult as to be impossible. Second, incorporate immediate, objective feedback mechanisms that reveal performance discrepancies. Third, design activities allowing for high repetition counts, creating opportunities for pattern recognition and technique refinement. Finally, structure exercises to focus exclusively on targeted skill components rather than diffusing attention across multiple capabilities simultaneously.

Feedback mechanisms represent the central nervous system of effective deliberate practice, enabling continuous correction and refinement. Objective measurement tools provide the most reliable feedback foundation—examples include recording and analyzing presentations, utilizing computational tools to evaluate written communication, or implementing standardized assessment rubrics for complex outputs. Supplement these objective measures with carefully selected external feedback sources, ideally individuals possessing domain expertise and psychological safety to provide candid observations. Implement structured feedback protocols that separate observation from interpretation and recommendation, preventing defensive responses that inhibit skill development. Additionally, develop self-feedback capabilities through metacognitive routines—brief reflection protocols conducted immediately after performance to identify specific elements for refinement before external feedback becomes available.

Scheduling considerations significantly impact practice effectiveness. Research consistently demonstrates the superiority of distributed practice (shorter sessions spaced over time) compared to massed practice (extended sessions concentrated in short timeframes). Implement spaced repetition scheduling where practice sessions for specific skills occur at increasing intervals as proficiency develops, aligning with research on optimal memory consolidation. Balance deliberate practice with performance activities by scheduling dedicated improvement sessions separate from regular work responsibilities, preventing the common pattern where developmental activities are perpetually deferred in favor of immediate deliverables. For professionals with significant time constraints, implement “microskilling” approaches—ultra-focused practice sessions of 10-15 minutes targeting extremely specific sub-skills that can be integrated into existing schedules without requiring substantial time blocks.

Environmental optimization plays a crucial role in practice effectiveness. Design physical and digital environments that eliminate distraction triggers, recognizing that deliberate practice requires sustained attention that environmental interruptions systematically undermine. Implement commitment devices that increase the psychological cost of practice avoidance—scheduling sessions with accountability partners, making public commitments to specific practice goals, or establishing consequence systems for missed sessions. Create practice environments incorporating retrieval conditions that approximate real-world application contexts, enhancing transfer of learning from practice to performance situations. Finally, develop environmental cues that trigger practice routines automatically, reducing the volitional energy required to initiate sessions and thereby increasing consistency. These environmental modifications transform deliberate practice from an occasional activity into a systematic professional development system.

Overcoming Plateaus and Maintaining Motivation

Performance plateaus represent predictable phases in skill development where progress appears to stall despite continued practice. These plateaus typically result from three primary mechanisms. First, automaticity plateaus occur when foundational aspects of a skill become unconscious through repetition, reducing cognitive load but also decreasing deliberate attention to refinement opportunities. Second, methodology plateaus emerge when existing techniques reach their maximum effectiveness, requiring fundamental approach changes rather than incremental improvements within the current framework. Third, conceptual plateaus develop when mental models underlying performance no longer adequately represent the complexity encountered at higher skill levels. Recognizing which plateau type you’re experiencing allows implementation of specific interventions rather than simply increasing practice volume—a common but usually ineffective response to perceived progress stagnation.

Strategic regression—temporarily sacrificing performance quality to enable breakthrough improvements—provides a powerful tool for overcoming plateaus. This approach involves intentionally disrupting established patterns by introducing significant technique modifications that initially reduce performance but create pathways to higher long-term capabilities. Implement strategic regression through technique deconstruction exercises where established skills are deliberately broken down to their components and reconstructed with critical modifications. Similarly, constraint training imposes artificial limitations forcing development of new approaches—examples include eliminating reliance on preferred tools, imposing unusually strict time constraints, or removing access to normally available information. These approaches temporarily increase cognitive load and performance variability while creating conditions for substantial capability expansion beyond current plateaus.

Motivation maintenance presents significant challenges during deliberate practice, as the intentionally challenging nature of effective practice activities often generates negative psychological states that must be managed. Implement motivational architecture with three key components. First, establish clear connection channels between current practice activities and meaningful long-term aspirations, reinforcing purpose when immediate motivation wanes. Second, develop immediate reward structures that provide psychological reinforcement for practice completion independent of performance improvements, which often emerge only after significant time investments. Third, create social accountability systems through practice groups, coaches, or accountability partners who provide both support and positive pressure for continued engagement. These motivation structures address both the approach motivation driving toward positive future states and avoidance motivation preventing regression to comfortable but ineffective practice patterns.

Customizing deliberate practice approaches based on individual differences significantly enhances sustainability. Analyze your personal feedback receptivity patterns to determine optimal feedback timing and framing—some individuals benefit from immediate feedback during performance while others respond better to consolidated feedback after completion. Similarly, understand your challenge sensitivity profile to calibrate optimal difficulty levels that provide sufficient stretch without triggering avoidance responses. Identify your intrinsic motivation drivers—whether autonomy, mastery, purpose, or social connection—and design practice activities emphasizing these elements. Recognize that productive struggle, while essential for growth, manifests differently across individuals; some experience it primarily as cognitive confusion while others encounter emotional resistance or physical discomfort. By tailoring deliberate practice to align with your psychological profile, you transform potentially aversive activities into personally sustainable improvement systems.

Practical Applications for Specific Professional Domains

Knowledge workers face unique deliberate practice challenges stemming from the invisible and complex nature of cognitive skills. Implement evidence-based approaches targeting three foundational capabilities. First, develop information processing skills through deliberate practice activities like comparative analysis exercises (identifying patterns across multiple information sources), synthetic note-taking protocols (transforming source material into novel conceptual structures), and time-constrained synthesis challenges (producing integrated analyses under strict time limitations). Second, enhance decision-making capabilities through structured post-decision reviews (systematically evaluating decision quality separate from outcomes), simulation exercises presenting compressed decision-making scenarios, and pre-mortems identifying potential failure modes before implementation. Third, strengthen communication precision through sentence-level editing processes focused on eliminating ambiguity, concept translation exercises requiring explanation of specialized knowledge to diverse audiences, and progressive summarization protocols distilling complex information into increasingly concise formats.

Management and leadership skills present deliberate practice difficulties due to their relationship-dependent nature and extended feedback cycles. Overcome these challenges by implementing microskilling approaches for specific leadership capabilities. Develop influence effectiveness through deliberate practice of framing techniques—presenting identical information with different contextual frameworks and measuring response differences. Enhance situational awareness through observation challenges requiring identification of specific interpersonal and organizational dynamics within defined timeframes. Strengthen coaching capabilities through role-play scenarios with standardized difficulty progressions and specific technique constraints. Supplement these targeted practices with simulation-based training where leadership scenarios are compressed into focused decision points with immediate feedback, allowing high-repetition practice of situations that occur infrequently in actual leadership roles.

Creative professionals can implement specialized deliberate practice approaches addressing both generative and evaluative aspects of creative work. For generative capabilities, implement constraint-based ideation challenges where creative outputs must satisfy progressively complex requirement sets, forcing exploration beyond established patterns. Develop systematic remix protocols where existing creative elements are deliberately recombined using specific methodological frameworks rather than intuitive processes. For evaluative capabilities, implement comparative critique methods where multiple solution alternatives are systematically assessed against explicit quality criteria, developing the pattern recognition central to creative discernment. Additionally, practice rapid iteration cycles where initial concepts undergo multiple transformation phases within compressed timeframes, building the refinement capabilities distinguishing elite creative performance from mere ideation ability.

Technological skill development presents unique deliberate practice opportunities due to the immediate feedback and controlled environments digital tools provide. Implement deliberate practice through reverse engineering exercises where existing code or systems are methodically deconstructed to identify underlying principles and patterns. Develop debugging capabilities through deliberately constructed problem scenarios with planted errors of progressive complexity and reduced information availability. Enhance architectural thinking through constraint challenges requiring system design under specific limitation sets—such as memory constraints, performance requirements, or technology restrictions. Supplement these approaches with deliberate exploration activities mapping unfamiliar technological domains through structured investigation protocols rather than undirected exposure. These technology-specific applications transform conventional skill development approaches into systematic deliberate practice aligned with research-validated principles of expertise development.

Measuring Progress: Tracking Systems and Success Indicators

Designing effective measurement systems requires identifying appropriate performance indicators that accurately reflect skill development rather than variable outcomes influenced by factors beyond the target capabilities. Implement a multi-dimensional measurement approach incorporating both leading indicators (metrics that change immediately with skill improvement) and lagging indicators (downstream performance outcomes that ultimately matter but appear only after sustained development). For each skill, establish specific performance metrics with clear measurement protocols—for example, communication skills might be measured through comprehension testing of recipients rather than subjective quality assessments. Complement quantitative measures with structured qualitative evaluations using standardized rubrics that convert subjective impressions into consistent assessment frameworks. This balanced measurement approach provides both the precision necessary for deliberate practice optimization and the ecological validity ensuring practice activities translate to meaningful performance improvements.

Tracking systems design significantly impacts deliberate practice effectiveness through its influence on feedback quality and motivation maintenance. Implement digital or physical tracking mechanisms capturing three key data categories: practice inputs (time invested, activity types, challenge levels), process metrics (focus quality, perceived effort, engagement levels), and performance outputs (capability measurements across relevant dimensions). Structure these systems to generate three critical views: longitudinal analysis revealing progress trajectories over extended timeframes, comparative analysis identifying patterns between practice approaches and performance outcomes, and variance analysis highlighting consistency development across repeated attempts. Ensure tracking systems balance comprehensive data collection with practical sustainability, as overly burdensome measurement processes frequently trigger abandonment despite their theoretical value.

Effective progress evaluation requires distinguishing between various improvement types often conflated in conventional assessment. Performance improvements represent enhanced capabilities within existing methodological approaches and conceptual frameworks—progress that typically appears as higher quality outputs or increased execution speed. Learning rate improvements manifest as accelerated capability development when encountering new challenges within the domain—progress visible primarily when acquiring novel skills rather than refining existing ones. Adaptability improvements emerge as enhanced performance stability across varying conditions and constraints—progress demonstrated through consistent effectiveness despite changing contexts. By deliberately assessing these distinct improvement dimensions, practitioners can identify whether deliberate practice is producing comprehensive expertise development or merely surface-level performance enhancements that may not transfer beyond specific conditions.

Objective self-assessment presents significant challenges due to cognitive biases systematically distorting perception of personal capabilities and development. Implement debiasing strategies through structured evaluation protocols that counteract these tendencies. Confirmation bias can be mitigated through deliberately documented disconfirmation searches—intentionally seeking evidence contradicting perceived progress. Availability bias is addressed by implementing comprehensive measurement systems rather than relying on easily recalled examples. Overconfidence effects can be reduced through calibration training comparing predicted performance with actual results across multiple attempts. Additionally, implement temporal comparison methods contrasting current capabilities with precisely documented past performance rather than relying on often-distorted memory of previous ability levels. These debiasing approaches create the objective self-perception necessary for effective deliberate practice targeting, preventing the common pattern where perceived strengths receive disproportionate attention while actual development needs remain unaddressed.

The Ultimate Guide to Notion for Productivity: Templates, Systems, and Workflows

Understanding Notion: More Than Just Another Productivity App

At its core, Notion represents a paradigm shift in productivity software, transcending traditional categories to create an entirely new class of workspace. Unlike conventional tools that specialize in specific functions—Evernote for notes, Trello for task management, Google Docs for documents—Notion provides a unified environment where these capabilities seamlessly integrate. This all-in-one approach eliminates the fragmentation that occurs when information is scattered across multiple platforms, reducing the cognitive overhead required to maintain separate systems. The structural foundation of Notion rests on “blocks,” modular content elements that can be easily manipulated, transformed, and nested within each other, creating a uniquely flexible canvas for organizing information.

What truly distinguishes Notion from other productivity tools is its architectural philosophy. Rather than presenting users with a predetermined structure, Notion offers a meta-layer—essentially a tool for building tools. This means that instead of adapting your workflow to fit software limitations, you can craft a digital environment precisely tailored to your cognitive style and organizational needs. The platform achieves this through an elegant combination of simple building blocks (pages, databases, toggles, embeds) that can be assembled into sophisticated systems ranging from basic note-taking to complex project management frameworks or knowledge management systems.

Understanding Notion’s relational database capabilities is crucial for unlocking its full potential. Unlike spreadsheets or simple tables, Notion databases allow information to be linked, filtered, and displayed in multiple views—Kanban boards, calendars, galleries, lists—without duplicating the underlying data. This relational structure mirrors how information naturally connects in our minds, enabling users to create systems that reflect the complex relationships between different types of content. For example, a task can simultaneously appear in a project database, on a department roadmap, and in a personal work queue, with updates in one location automatically reflected everywhere.

The flexibility that makes Notion powerful can initially seem overwhelming. Many new users experience what productivity experts call “blank page paralysis”—uncertainty about how to begin structuring their workspace. This is where understanding fundamental Notion concepts becomes essential. Rather than diving immediately into complex setups, successful adoption typically follows a progressive path: beginning with simple pages and notes, advancing to basic databases, and gradually implementing more sophisticated relational systems as familiarity increases. This evolutionary approach allows users to develop an intuitive understanding of Notion’s capabilities while creating immediately useful structures that can expand over time.

Setting Up Your Notion Workspace: Foundation for Success

Creating an effective Notion workspace begins with intentional architecture that balances accessibility with organizational clarity. The sidebar serves as your primary navigation framework and should be thoughtfully structured to provide immediate access to essential resources while maintaining a clean, uncluttered appearance. Begin by establishing top-level categories that reflect your primary life or work domains—perhaps “Personal,” “Work,” and “Projects.” Within each category, limit visible pages to those accessed daily or weekly, nesting less frequently used resources within these primary containers. This hierarchical approach creates a “progressive disclosure” system where information complexity increases as you navigate deeper, preventing cognitive overwhelm from too many visible options.

Template pages serve as the foundation for consistent information capture and processing. Develop standardized templates for recurring content types like meeting notes, project briefs, weekly reviews, or process documentation. Each template should include predetermined sections with clear guidance on what information belongs where, reducing decision fatigue during creation while ensuring important details aren’t overlooked. For meeting notes, for instance, include dedicated sections for attendees, objectives, discussion points, decisions, and action items. Store these templates in a dedicated “Resource” section for easy access, or utilize Notion’s template button feature to embed creation capabilities directly where they’re needed.

Database design represents the most critical aspect of workspace setup, as these structures will house your actionable information. Begin with foundational databases that support core workflows—a comprehensive task management system, a project tracker, a resource library, and perhaps a content calendar. For each database, carefully consider the properties (columns) that provide meaningful context and filtering capabilities. While it’s tempting to create numerous properties, focus on those that enable critical workflows: assignment fields for delegation, date fields for timeline management, status fields for progress tracking, priority indicators for focus management, and relation fields to connect related items across databases.

The visual presentation of your workspace significantly impacts both functionality and sustained engagement. Apply consistent formatting conventions throughout your workspace to create visual patterns that enhance information processing. Establish a standardized color system where specific colors consistently represent certain types of information—perhaps blue for client-related content, green for completed tasks, or orange for high-priority items. Similarly, develop icon conventions that provide immediate visual cues about page or database types. This visual language reduces cognitive load by allowing rapid recognition of information categories without requiring conscious processing. For substantial workspaces, consider developing a dedicated “Workspace Guide” page documenting these conventions and navigation principles, ensuring continuity even as your system evolves.

Essential Notion Templates for Maximum Productivity

A comprehensive task management system forms the cornerstone of any productive Notion workspace. The most effective approach leverages a master task database with multiple filtered views to address different workflow contexts. Design your task database with properties that enable meaningful organization: status fields (To Do, In Progress, Waiting, Complete), priority levels, effort estimates, due dates, and project/area tags. Then create specialized views that transform this single data source into context-specific task lists: a “Daily Focus” view showing only today’s highest priorities, a “Waiting For” view tracking delegated items, or project-specific views displaying only relevant tasks. The power of this approach lies in its unified data structure with contextual views, eliminating the fragmentation that occurs when tasks are scattered across multiple systems.

Project management in Notion thrives on a dual-database approach that balances high-level oversight with granular execution. Create a Projects database containing entries for each initiative, including properties for status, timeline, objectives, stakeholders, and resources. This database provides portfolio-level visibility across all work streams. Then, establish a relation between your task database and project database, allowing tasks to be linked to specific projects while maintaining their presence in your unified task system. Each project page can then display its related tasks in a filtered view, creating dedicated project workspaces while preserving the benefits of centralized task management. For complex projects, consider adding supplementary databases for project-specific resources like meeting notes, deliverables, or reference materials, all linked through Notion’s relational capabilities.

Knowledge management represents Notion’s distinctive strength compared to traditional productivity tools. Develop a resource library database to catalog reference materials, documentation, and institutional knowledge. Structure this database with properties for categories, tags, creation dates, and importance ratings. Then create filtered views that transform this repository into specialized knowledge bases—perhaps a “New Employee Onboarding” view showing only orientation resources, or a “Client Guidelines” view displaying client-facing documentation. Within individual resource pages, leverage Notion’s toggle feature for progressive disclosure of detailed information, allowing users to expand only sections relevant to their current needs. Enhance knowledge discoverability by establishing a consistent tagging taxonomy and including a dedicated search guide explaining both basic and advanced query techniques for finding specific information.

Weekly and quarterly review templates provide essential reflection infrastructure for continuous improvement. Design a weekly review template with sections for achievement reflection, obstacle analysis, upcoming work planning, and metadata capture about energy levels and focus quality. Schedule automated reminders to complete these reviews and link them to a review database that allows pattern recognition across time periods. Similarly, develop quarterly planning templates that facilitate goal setting, strategy refinement, and resource allocation, with explicit connections to your project and task databases. These reflection templates transform Notion from merely a productivity system into a personal development platform that helps identify patterns, remove roadblocks, and progressively refine your working methods based on empirical self-knowledge gathered through consistent review practices.

Building Workflows That Stick: From Setup to Daily Use

The most elegantly designed Notion system proves worthless without sustainable integration into daily workflows. Successful adoption requires creating deliberate habits that consistently route information and activity through your Notion workspace. Begin by establishing a morning orientation ritual that uses Notion as its centerpiece. Design a Daily Dashboard page that aggregates critical information—today’s priority tasks, upcoming meetings, relevant notes, and current projects—providing a mission control center for your day. This dashboard should offer both immediate actionable information and rapid navigation to frequently accessed resources, making it genuinely useful rather than merely visually impressive. Configure this page as your default workspace opening view, ensuring your day begins with structured orientation rather than reactive responses to incoming stimuli.

Information capture represents a critical workflow juncture where systems often fail. Develop frictionless intake mechanisms that make adding content to Notion the path of least resistance. Leverage the mobile app for capturing ideas on the go, the web clipper for saving online resources, and email forwarding for processing messages directly into your workspace. Create specialized “Inbox” databases with minimal required properties for rapid capture, then establish regular processing routines that sort this incoming information into appropriate permanent locations. This two-phase approach—quick capture followed by deliberate processing—prevents valuable information from being lost without requiring complex categorization during initial collection, when friction would likely lead to abandonment.

Task processing workflows require particular attention to prevent the common productivity system failure of creating tasks that are never reviewed. Implement a clear task lifecycle within your system: creation, clarification, execution, and completion review. During clarification, ensure each task has an explicit next physical action rather than vague aspirations, following productivity expert David Allen’s methodology. Develop consistent conventions for task properties, such as prefixing similar actions (e.g., “Call: Client,” “Draft: Proposal,” “Review: Contract”) to create visual patterns that facilitate rapid processing during reviews. Establish regular task review sessions—perhaps daily for current work and weekly for comprehensive system review—that are time-blocked on your calendar as non-negotiable appointments with yourself.

Cross-platform integration enhances workflow sustainability by connecting Notion with complementary tools in your digital ecosystem. Utilize Notion’s native integrations or third-party automation platforms like Zapier to create bidirectional connections with email, calendars, communication tools, and specialized applications. For example, configure meeting events to automatically generate Notion preparation pages, or create systems where specific email categories are routed directly to relevant Notion databases. These integrations reduce the friction of context-switching between different tools, increasing the likelihood that your Notion workspace remains the central hub for information rather than one of many competing repositories. Remember that each transition between applications represents a potential point of workflow failure, so prioritize integrations that minimize these costly context shifts.

Advanced Notion Techniques for Power Users

Database formulas elevate Notion from an information management tool to a dynamic workspace that performs calculations, automates categorization, and surfaces insights. Master the essential formula building blocks, beginning with simple arithmetic and logical operators, then advancing to text manipulation and date functions. Create compound properties that derive meaning from other fields—perhaps calculating project health scores based on deadline proximity and completion percentage, or automatically categorizing tasks based on naming conventions. Formula properties can also generate contextual instruction text, showing relevant guidance based on an item’s current status or category. For complex formulas, develop them incrementally in a dedicated testing page before implementing in production databases, and document their logic for future reference.

Notion’s linked database capabilities enable sophisticated dashboard creation without duplicating information. Develop executive overview pages that aggregate critical metrics and high-priority items from multiple databases, creating command centers for different work contexts. For each linked database, apply specific filters and sorts to display only immediately relevant information—perhaps showing only troubled projects on a manager’s dashboard, or only this week’s deliverables on a daily planning page. Use Notion’s “Create a view” feature rather than duplicating databases to ensure all views reflect current information. For comprehensive dashboards, leverage a modular design with collapsible sections that provide progressive disclosure, allowing users to focus on specific dashboard elements without visual overwhelm.

Database relations transform Notion from a collection of separate information containers into an interconnected knowledge network that mirrors the actual relationships between different types of information. Implement bi-directional relationships between related databases—connecting projects to resources, tasks to reference materials, or team members to responsibilities. For complex systems with numerous relations, develop a relationship map page documenting how information flows between different databases, preventing confusion as your system scales. Master the creation of “Rollup” properties that aggregate information across relationships, such as calculating the total estimated hours for all tasks associated with a project, or displaying the nearest deadline among all items related to a specific client. These rollup properties create valuable insights at higher levels of your information hierarchy without requiring manual data aggregation.

The template button feature provides powerful workflow automation capabilities that standardize information creation while reducing friction. Beyond basic page templates, implement sophisticated template buttons that pre-populate multiple properties, establish relationships, and even create structured content based on select inputs. For example, a “New Client Project” button might generate not only a project entry with standardized phases but also create associated meeting notes, resource collections, and initial tasks all properly linked together. Similarly, develop intelligence-embedded templates that include conditional sections appearing based on selected options, ensuring users receive only relevant fields and guidance for their specific scenario. These advanced templates transform complex multi-step processes into single-click operations, dramatically reducing the cognitive overhead required to maintain organizational systems and ensuring consistent information architecture even as multiple contributors add to your workspace.

Team Collaboration and Scaling Your Notion Workspace

Transitioning from individual productivity to team collaboration requires thoughtful workspace architecture that balances shared access with appropriate boundaries. Implement a nested structure where broad company information occupies top-level pages accessible to all members, while team-specific and individual workspaces exist as sub-pages with granular permission settings. This hierarchical approach allows team members to easily access organization-wide resources while maintaining focused environments for their specific work. Develop clear naming conventions that signal page ownership and audience—perhaps prefixing shared resources with department identifiers or using consistent icon systems to indicate access levels. These visual cues reduce confusion about which spaces welcome collaboration and which serve individual productivity needs.

Effective team workflows require standardized operating procedures that clearly define how collective information will be managed. Create explicit documentation about where different types of information belong, how status updates should be communicated, and when synchronization between team members occurs. Implement centralized request systems using Notion forms that route incoming work to appropriate databases, ensuring consistent intake processes rather than scattered communications across email and messaging platforms. Develop specialized collaboration views within task and project databases that filter information based on team member assignments, creating personalized workspaces while maintaining a unified data structure. These standardized processes transform Notion from a productivity tool into a comprehensive operating system for team coordination.

Meeting management represents a common friction point in team environments that Notion can substantially improve. Develop a meeting database that tracks recurring discussions, with templates for different meeting types (standups, reviews, planning sessions, one-on-ones). Structure these templates to include pre-meeting preparation requirements, explicit agenda sections, dedicated decision-recording areas, and action item capture that automatically populates your task database. Implement a consistent practice of creating meeting pages in advance, collaboratively building agendas, and routing all meeting-generated actions through your unified task system. This systematic approach transforms meetings from isolated conversations into integrated components of your broader workflow, ensuring that discussions translate into trackable progress rather than disconnected conversations.

As workspaces scale, performance optimization becomes increasingly important. Implement architectural practices that maintain system responsiveness even as information volume grows. Large databases should be segmented by archiving completed or inactive items to separate historical databases that maintain relational integrity without burdening active views. For complex pages with multiple embedded databases, leverage toggles and tabs to load content conditionally rather than simultaneously rendering all elements. Develop systematic approaches to media management, using external storage for large files with Notion serving as the organizational interface rather than the storage mechanism. These technical optimizations ensure that your workspace remains responsive as it evolves from a personal productivity system into a comprehensive knowledge repository, preventing the performance degradation that often undermines adoption of scaling systems.

The Pareto Principle at Work: How to Identify the 20% of Tasks That Generate 80% of Your Results

Understanding the Pareto Principle: The 80/20 Rule Explained

The Pareto Principle, commonly known as the 80/20 rule, is a powerful concept that can transform how professionals approach their work. Originally observed by Italian economist Vilfredo Pareto in 1896 when he noticed that approximately 80% of Italy’s land was owned by just 20% of the population, this principle has since been recognized across numerous fields and disciplines. In essence, the principle suggests that roughly 80% of effects come from 20% of causes, creating a disproportionate relationship between inputs and outputs.

When applied to workplace productivity, the Pareto Principle indicates that approximately 80% of your results stem from just 20% of your efforts. This imbalance highlights a critical insight: not all tasks are created equal. Some activities yield substantially higher returns than others, while many time-consuming tasks contribute relatively little to your overall objectives. Understanding this fundamental inequality allows professionals to reassess their approach to work, focusing their energy where it matters most.

The mathematical precision of the 80/20 split shouldn’t be taken literally in every context. The exact ratio may vary—it could be 70/30 or 90/10—but the core concept remains valid: a minority of inputs generally produces a majority of outputs. What’s particularly fascinating about the Pareto Principle is its fractal nature. When you examine the most productive 20% of your activities, you’ll often find that even within that subset, another 80/20 distribution exists. This recursive pattern allows for continuous refinement and optimization of workflows.

By embracing the Pareto Principle, professionals can break free from the trap of busyness and move toward genuine productivity. Rather than spreading attention thinly across numerous tasks, the principle encourages a more strategic allocation of resources. This shift in mindset doesn’t mean neglecting the 80% of activities that generate 20% of results—many of these tasks remain necessary. Instead, it means approaching work with a clearer understanding of value creation, allowing for more intentional decisions about how time and energy are invested.

Identifying Your High-Value Activities: Methods and Approaches

Identifying the critical 20% of activities that drive 80% of your results requires deliberate analysis and reflection. One effective approach is to conduct a comprehensive task audit. Begin by documenting all work-related activities over a two-week period, noting the time spent on each task and, importantly, the tangible outcomes produced. This data-driven exercise often reveals surprising patterns about where your time is actually going versus where it creates the most value. After collecting this information, categorize tasks based on their contribution to key performance indicators or strategic objectives, which helps distinguish between high-value and low-value activities.

Another powerful method involves analyzing your peak performance periods. Reflect on times when you achieved exceptional results or received recognition for your contributions. What specific activities were you engaged in during these peak periods? What projects yielded the greatest return on investment for your time? By examining these success patterns, you can identify the signature activities that consistently deliver outstanding results. These retrospective analyses often highlight that breakthrough accomplishments stemmed from a relatively small subset of your overall workload.

Stakeholder feedback provides another valuable lens for identifying high-impact tasks. Consult with managers, colleagues, clients, or team members about which of your contributions they value most. Their perspective might reveal impact areas you’ve overlooked or undervalued. Additionally, consider utilizing assessment tools like the Eisenhower Matrix, which helps classify tasks based on their urgency and importance, or value stream mapping, which visualizes workflow processes to identify where the greatest value is created and where waste occurs.

When conducting this analysis, be mindful of common pitfalls. Many professionals mistakenly equate busyness with productivity or confuse activity metrics (like emails sent or meetings attended) with outcome metrics (such as revenue generated or problems solved). Focus on identifying tasks that directly advance key objectives rather than those that merely keep you occupied. Remember also that high-value activities might not always be the most immediately satisfying or visible—some critical work happens behind the scenes but creates substantial downstream effects. Through methodical assessment of your workflow, you can develop clarity about which activities deserve the lion’s share of your time and attention.

Strategies for Maximizing Focus on High-Impact Tasks

Once you’ve identified your high-impact activities, implementing effective strategies to focus on these tasks becomes essential. Time blocking stands out as a particularly powerful approach, involving the deliberate scheduling of uninterrupted periods dedicated to your most valuable work. Rather than hoping to find time for important tasks, you proactively reserve prime productivity hours—typically when your energy and concentration are at their peak—exclusively for high-value activities. This method transforms your calendar from a repository of meetings into a strategic tool for prioritizing what matters most.

Developing a robust system for task triage is equally important. Not all requests deserve equal attention, regardless of who makes them. Create explicit criteria for evaluating incoming tasks based on their alignment with your primary objectives and their potential return on time invested. With these criteria established, practice conscious delegation of lower-value activities wherever possible. Delegation isn’t about avoiding work but rather about ensuring that tasks are handled at the appropriate level within an organization, freeing up your capacity for work that requires your unique skills and perspective.

Environmental optimization plays a crucial role in maintaining focus on high-value work. Design your workspace to minimize distractions and create friction for low-value activities. This might involve using website blockers during focused work sessions, establishing clear signals to colleagues about when you’re in deep work mode, or even creating physical distance between yourself and potential interruptions. Additionally, leverage technology judiciously by employing automation tools for repetitive tasks and communication filters that prevent non-essential notifications from breaking your concentration.

Perhaps most importantly, cultivate the habit of regular reflection and recalibration. Schedule weekly reviews to assess whether your time allocation truly reflects your priorities and to identify creeping inefficiencies. During these reviews, be honest about where your discipline may have lapsed and adjust accordingly. Remember that maintaining focus on high-value activities isn’t a one-time decision but an ongoing practice that requires vigilance and periodic adjustment. By implementing these strategies consistently, you’ll gradually shift your working patterns to emphasize the vital few activities that drive the majority of your results.

Overcoming Common Obstacles to 80/20 Productivity

Implementing the Pareto Principle in daily work routines inevitably encounters resistance and challenges. Perhaps the most pervasive obstacle is the psychological attachment many professionals develop to busyness over productivity. Our work culture often rewards visible activity and long hours rather than meaningful outcomes, creating an environment where checking off numerous small tasks can feel more satisfying than tackling fewer, more significant challenges. To overcome this mindset, establish concrete metrics that measure results rather than activity levels, and regularly remind yourself of the difference between motion and progress.

External expectations and organizational culture can also present formidable barriers. Colleagues, managers, and clients may expect immediate responses to all communications or fail to distinguish between urgent and important requests. Addressing these challenges requires diplomatic boundary-setting and expectation management. Communicate your prioritization approach clearly to stakeholders, explaining how your focus on high-impact activities ultimately benefits everyone involved. When necessary, negotiate reasonable response times for lower-priority matters and educate team members about the value of preserving focused work time.

The allure of digital distractions presents another significant hurdle. The average professional now faces an unprecedented volume of notifications, messages, and information streams competing for attention. These interruptions are particularly problematic because they fragment focus and create context-switching penalties that dramatically reduce cognitive performance. Combat this by implementing technical solutions like notification pauses and dedicated offline periods, but also develop the self-awareness to recognize when you’re using low-value digital activities as an escape from more challenging high-value work.

Finally, perfectionism and the fear of missing out (FOMO) can undermine effective prioritization. Some professionals struggle to focus on the vital few tasks because they worry about potential consequences of deprioritizing the trivial many. Remember that applying the Pareto Principle doesn’t mean completely neglecting the 80% of less impactful activities—it means giving them proportionally less attention. Start with small experiments in reallocating your time and document the outcomes. As you witness the benefits of focusing on high-leverage activities, your confidence in this approach will naturally grow, making it easier to overcome these psychological barriers.

Measuring Success: Tracking the Impact of Your 80/20 Approach

Implementing an 80/20 approach is only valuable if it produces measurable improvements in your results. Establishing clear metrics is essential to evaluating whether your focus on high-leverage activities is yielding the expected benefits. Begin by selecting quantifiable indicators that directly reflect your primary objectives. For sales professionals, this might include conversion rates or revenue generated; for knowledge workers, it could involve project completion rates or quality assessments; for managers, metrics might focus on team performance and outcomes. Whatever your role, identify metrics that capture meaningful outcomes rather than just activity levels.

Once you’ve established appropriate metrics, conduct regular comparative analyses between periods of traditional work approaches and periods when you’ve strictly applied 80/20 principles. This before-and-after examination provides empirical evidence of the impact of your prioritization efforts. To enhance this analysis, maintain a productivity journal documenting not only what you accomplish each day but also your energy levels, satisfaction, and the specific high-value activities you prioritized. This qualitative data complements quantitative metrics, offering insights into the less tangible benefits of the Pareto approach.

Another powerful assessment method involves calculating your personal return on time invested (ROTI). For each significant activity, estimate the value generated relative to the time spent. This calculation, while sometimes subjective, helps quantify the differential impact of various tasks and highlights those with disproportionate returns. Over time, tracking your ROTI for different activities will sharpen your intuition about where to invest your limited time and energy.

Importantly, recognize that full implementation of the Pareto Principle often produces benefits beyond immediate performance metrics. Many professionals report reduced stress, greater work satisfaction, and improved work-life balance when they focus on high-impact activities. These secondary benefits, while harder to quantify, significantly contribute to sustainable performance over the long term. As you track the impact of your 80/20 approach, remain open to refining your understanding of what constitutes truly high-value work. The definition of the vital 20% may evolve as you gain experience and as organizational priorities shift, requiring ongoing assessment and adjustment of your focus areas.

Automation for Beginners: 15 Simple Workflows That Save 5 Hours Weekly

Understanding Automation and Its Benefits

Automation, in its simplest form, refers to the use of technology to perform tasks with minimal human intervention. This concept has rapidly gained traction in various fields, including business, home management, and personal productivity. The primary aim of automation is to streamline processes, thus allowing individuals and organizations to allocate their time and resources more efficiently.

For beginners, understanding the significance of automation is crucial. One of the most compelling benefits is the substantial time savings it offers. By automating routine tasks such as data entry, email responses, or social media posting, individuals can free up hours each week that can be redirected toward more strategic activities. This increase in efficiency not only enhances productivity but also allows for better work-life balance. Moreover, automation minimizes human error. When tasks are performed consistently by automated systems, the risks associated with manual handling—such as typos, missed deadlines, and overlooked details—are significantly reduced.

Real-world examples underline the effectiveness of automation. For instance, small business owners often leverage tools like customer relationship management (CRM) software to automate follow-ups and lead tracking, which helps in maintaining customer relationships with reduced effort. Another notable example is freelance professionals who utilize automation for scheduling appointments and managing finances, enabling them to focus on their core work. In households, people implement smart home technologies that automate heating, lighting, and security systems, paving the way for enhanced comfort and safety.

As individuals begin to explore automation, it becomes evident that even simple workflows can lead to notable improvements in daily life. By taking initial steps to automate tasks, both individuals and businesses can experience heightened productivity, ultimately resulting in significant time savings and improved overall performance.

Identifying Tasks to Automate

Automation can significantly enhance productivity by streamlining repetitive tasks in daily routines. To begin the automation journey, it is crucial to identify tasks that are suitable for automation. A systematic approach to recognizing these tasks is through conducting a task audit. Begin by tracking your daily activities for a week or two; note all your tasks, their frequency, and the time spent on each. This can reveal patterns and help pinpoint tasks that are both time-consuming and repetitive.

Once you have a comprehensive list of tasks, categorize them based on their frequency and time consumption. For instance, tasks that occur daily, such as data entry or email sorting, should be prioritized for automation opportunities. Longer tasks that are performed less frequently, like monthly reporting, can also be candidates for automated workflows. By breaking down tasks in this manner, you can visualize which activities consume the most time and are repeated regularly, making them ideal for automation.

After categorizing tasks, evaluate their suitability for automation. Tasks that follow a clear set of rules or processes are typically easier to automate. Consider whether a task requires human judgment or creativity; if it does, it may not be the best candidate for automation. Additionally, consider the potential return on investment; automating a task that saves only a few minutes may not be worthwhile, while a process that frees up several hours per week could be highly beneficial.

By following this structured approach, you will successfully identify tasks that can be automated effectively. Implementing automation for these workflows can lead to significant time savings, allowing you to focus on more important responsibilities and projects that demand your attention.

15 Simple Automation Workflows to Implement

Automation can significantly enhance productivity, especially for beginners. Here are 15 straightforward workflows across various categories designed to save time and streamline tasks. Each workflow is accompanied by the tools required and step-by-step instructions for setup.

1. Email Sorting: Utilize filters in Gmail or Outlook to automatically categorize incoming emails based on sender or keywords. This saves time spent on manual sorting.

2. Scheduled Email Responses: Use tools like Boomerang for Gmail to schedule responses. You can draft replies in advance and set the date and time for them to be sent automatically.

3. Social Media Posting: Platforms like Buffer or Hootsuite allow users to schedule posts across multiple social media accounts simultaneously, ensuring consistent engagement without daily effort.